The U.S.-China Trade War: A Global Economic Quagmire

Yo, listen up, folks! We’ve got a full-blown economic demolition site on our hands—the U.S.-China trade war. What started as a few tariff warning shots under Trump’s administration has turned into a full-scale wrecking ball swinging through global supply chains. Sheesh, it’s like watching two construction crews accidentally bulldoze the same building—except this time, the collateral damage is hitting wallets worldwide. Let’s break down this mess, brick by brick.

—

Round One: Tariffs and Retaliatory Smackdowns

The Trump administration kicked things off by slapping tariffs on Chinese imports like it was Black Friday at Home Depot—billions of dollars worth of goods, all in the name of fighting “unfair trade practices.” But China? Oh, they didn’t just take it lying down. Beijing fired back with their own tariffs, hitting $20 billion of U.S. goods with 10-15% levies. Talk about a heavyweight fight—neither side was backing down.

And it didn’t stop there. China got creative, throwing regulatory punches like export controls on rare earth minerals—the stuff the U.S. needs for semiconductors and defense tech. No rare earths? Good luck building your fancy gadgets, America. Meanwhile, Uncle Sam’s companies found themselves locked out of Chinese markets, turning the business landscape into a bureaucratic obstacle course.

—

The Currency Games and “Joke” Tariffs

Here’s where things get shady. China started playing with the yuan like it was a yo-yo, letting it depreciate to make their exports cheaper. Smart move, right? U.S. tariffs sting less when your goods are suddenly a bargain. But then Beijing cranked it up to 125% tariffs on some U.S. imports—yeah, you heard that right. Chinese officials even called it a “joke,” which tells you everything you need to know: they’re in it to win it, no matter how absurd the numbers get.

Meanwhile, U.S. consumers and businesses are stuck holding the bag. Prices on everything from electronics to farm equipment shot up, and supply chains got tangled like a pile of discarded rebar. The global economy? Oh, it’s feeling the tremors too—stock markets panicking, recessions looming, and everyone from Germany to Vietnam sweating over where the next tariff bomb drops.

—

Diplomatic Hardhats and the Global Fallout

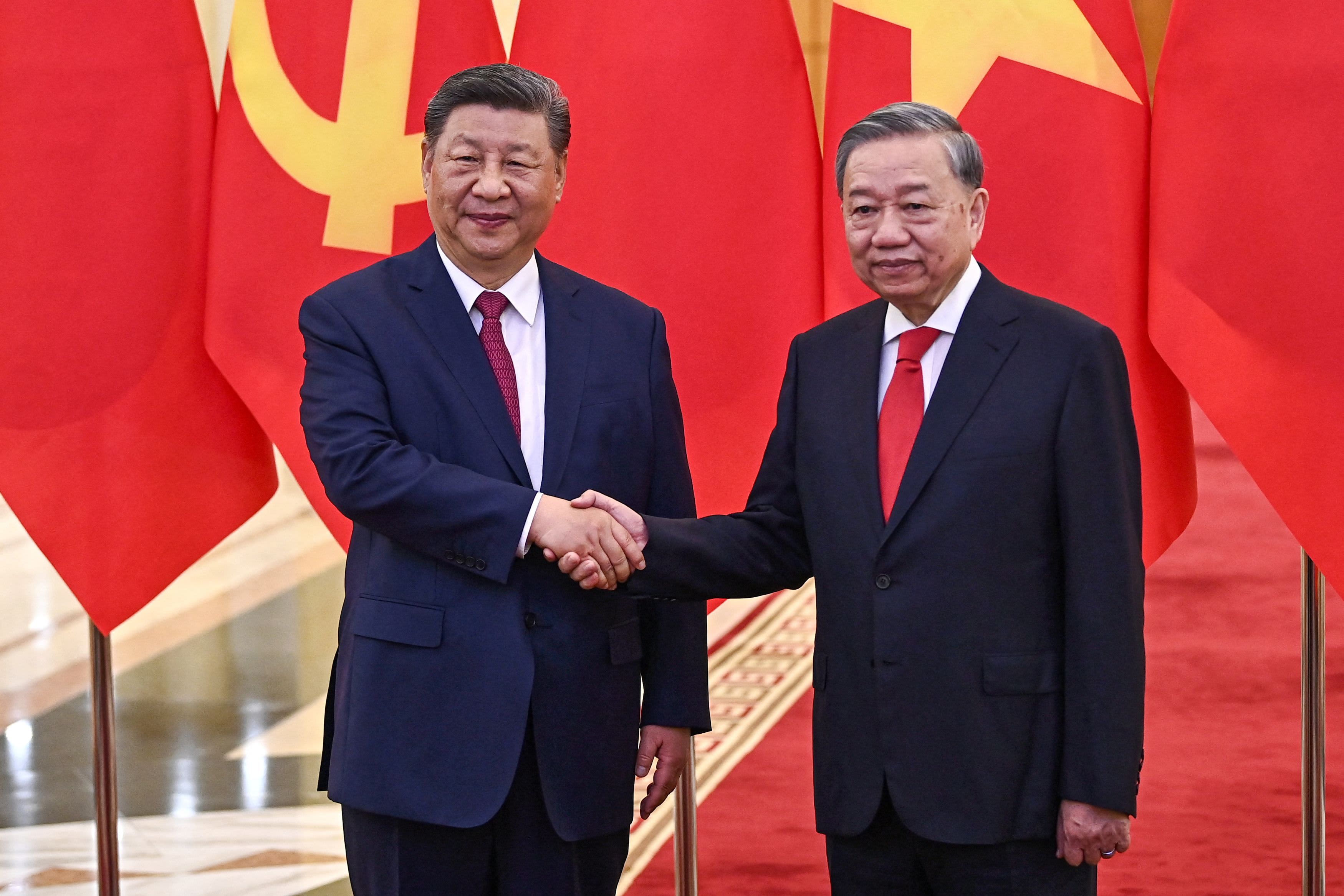

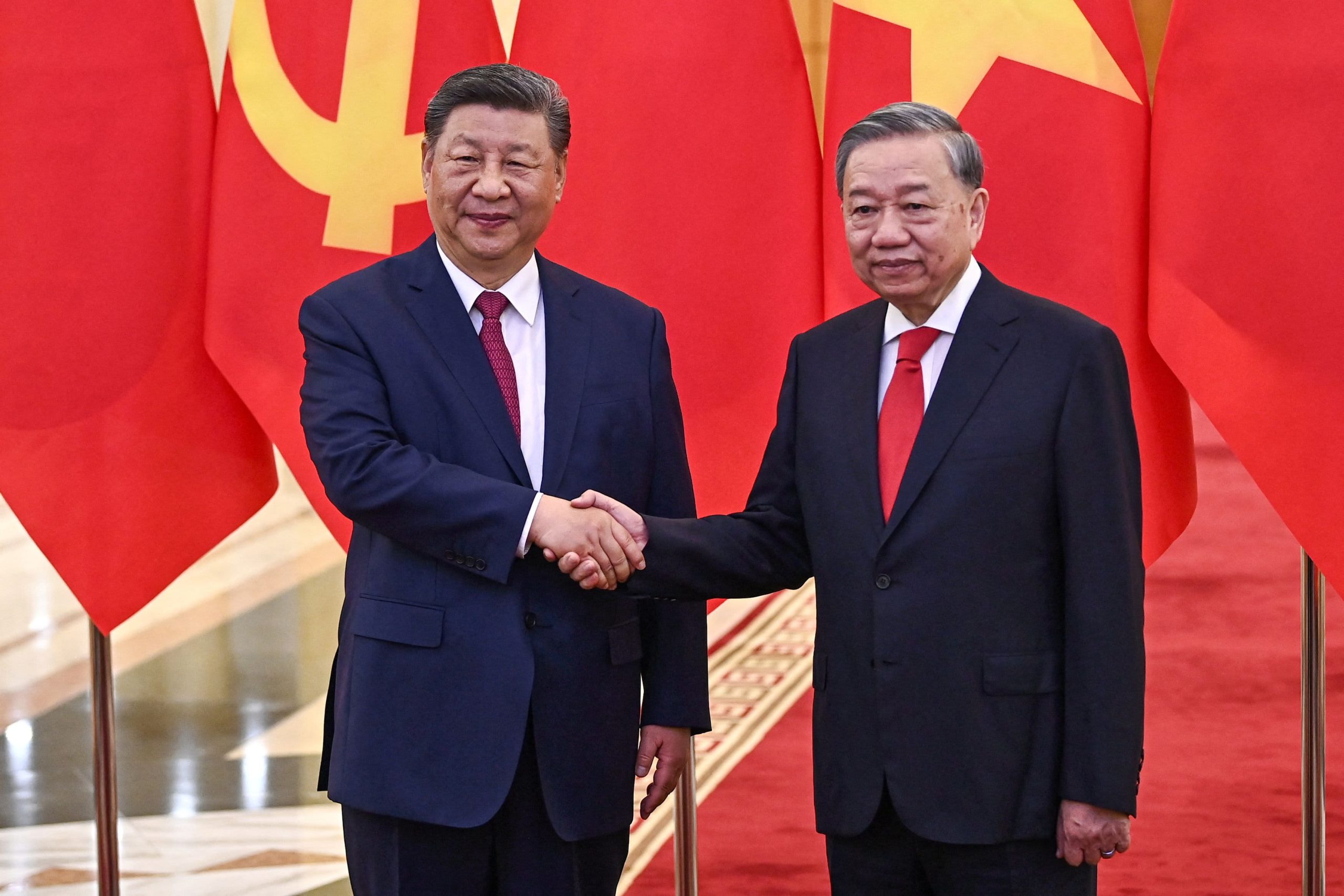

This isn’t just about economics—it’s a full-on geopolitical cage match. China’s been working the room, warning other countries not to side with the U.S. or risk being “selfish and shortsighted.” President Xi’s been shaking hands and cutting deals left and right, building alliances that could leave the U.S. out in the cold. Think of it like a high-stakes game of musical chairs, and the music’s about to stop.

The ripple effects are brutal. Smaller economies dependent on U.S.-China trade are getting squeezed, supply chains are relocating (slowly and painfully), and businesses are stuck in limbo, unsure whether to invest or bail. The worst part? There’s no clear endgame. The U.S. might ease some tariffs to spare consumers, but the core issues—trade deficits, intellectual property theft, market access—are still a tangled mess of rebar and concrete.

—

Wrapping Up the Debris

So here’s the deal: this trade war isn’t just a spat between two economic giants—it’s a wrecking ball swinging through the global economy. Tariffs, currency tricks, and diplomatic arm-twisting have turned what should’ve been a negotiation into a demolition derby. And while both sides are still talking (kinda), the real question is whether they’ll ever agree on how to rebuild what’s been smashed.

One thing’s for sure: the world’s watching, wallets are hurting, and until someone brings a real blueprint to the table, we’re all just dodging falling debris. Stay safe out there, folks—this job site’s far from clean.

发表回复